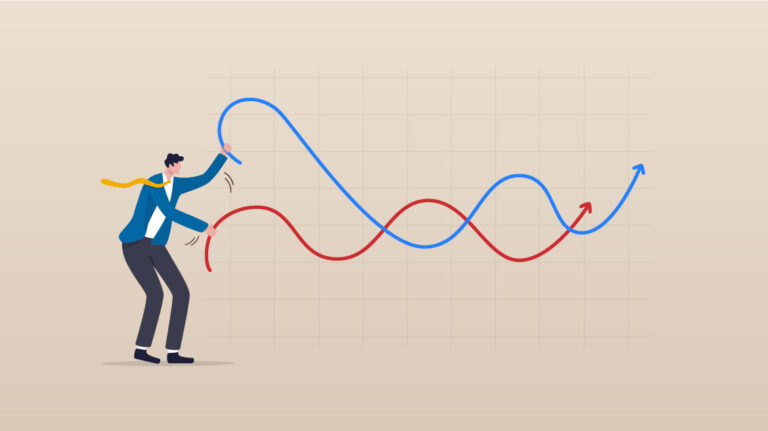

Exchanging monetary business sectors offers various methodologies, each taking care of various exchanging styles and chance cravings. Two normal exchanging styles are swing exchanging and day exchanging. While the two methodologies expect to benefit from cost changes, they vary altogether as far as time periods, techniques, and hazard levels. In this article, we will contrast swing exchanging and day exchanging with assistance you figure out which system suits you best.

Swing Exchanging: The Patient Methodology

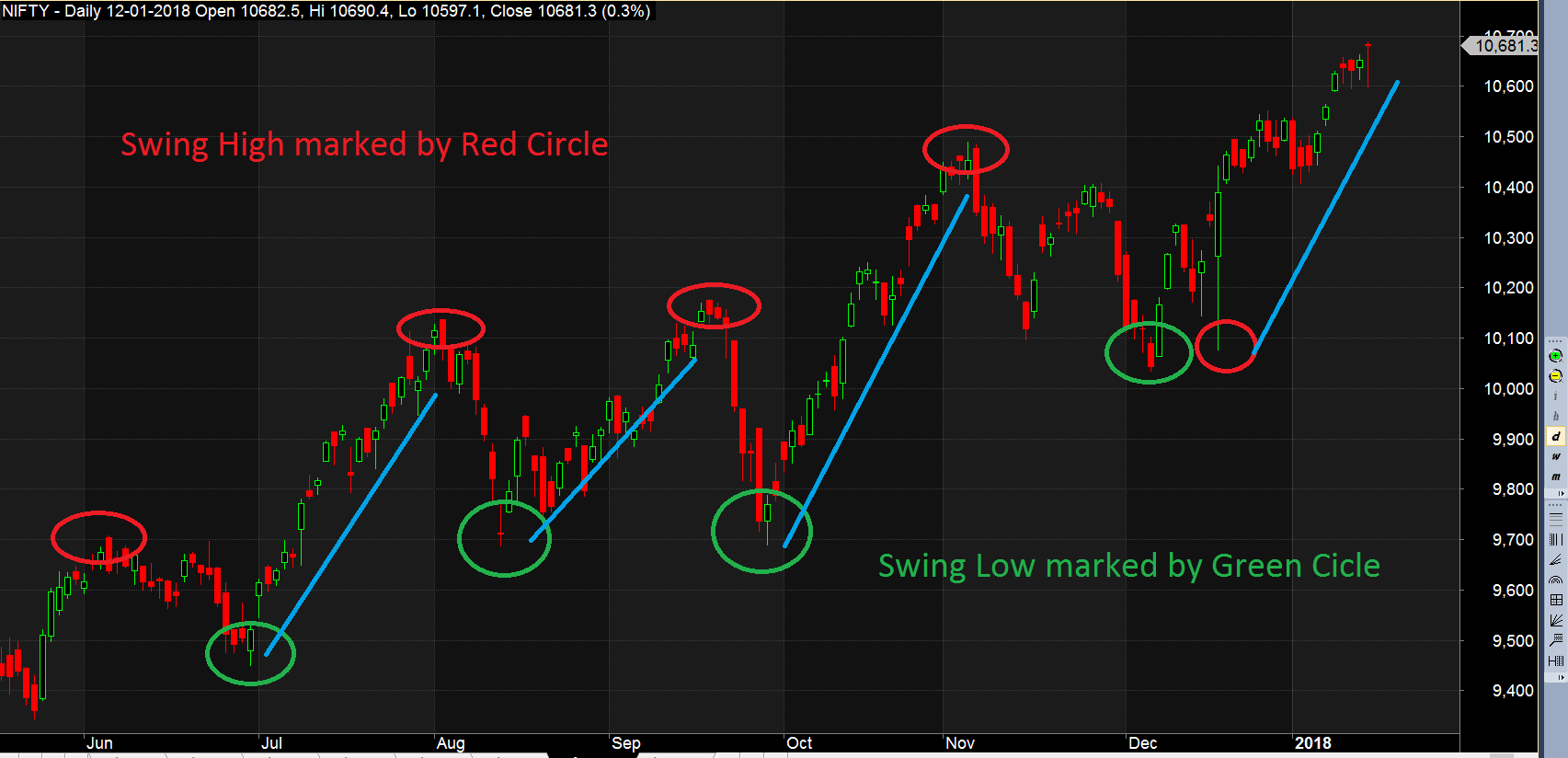

Swing exchanging is a medium-term exchanging style that intends to catch cost swings inside a pattern. Not at all like day exchanging, which includes opening and shutting positions inside similar exchanging day, swing dealers stand firm on footholds for a few days, weeks, or even months. Here are a few critical qualities of swing exchanging:

1. Time period: Swing merchants commonly investigate everyday or week after week value graphs to recognize expected passage and leave focuses. This more extended time span considers more loosened up navigation.

2. Techniques: Swing brokers utilize specialized examination and outline examples to distinguish patterns and inversions. They frequently hang tight for affirmation prior to entering an exchange, making them less helpless to intraday unpredictability.

3. Risk: Swing exchanging includes less continuous exchanging, decreasing the effect of exchange expenses and market clamor. Notwithstanding, positions are held for longer, presenting merchants to expedite gambles.

4. Way of life: Swing exchanging is reasonable for the people who have regular positions or different responsibilities. It calls for less time checking the business sectors contrasted with day exchanging.

Day Exchanging: The High speed Approach

Day exchanging is a momentary exchanging style that includes trading monetary instruments inside a similar exchanging day. Informal investors expect to benefit from intraday cost developments. Here are a few vital qualities of day exchanging:

1. Time span: Informal investors center around transient cost outlines, like one-moment or five-minute stretches, to go with quick choices. They look to gain by brief cost changes.

2. Systems: Informal investors depend vigorously on specialized investigation, utilizing markers and diagram examples to distinguish passage and leave focuses. They frequently execute different exchanges a solitary day.

3. Risk: Day exchanging conveys higher exchange costs because of successive exchanging. It additionally opens dealers to intraday unpredictability and the potential for fast misfortunes.

4. Way of life: Day exchanging calls for full-time devotion. Merchants need to intently screen the business sectors all through the exchanging day, making it unacceptable for those with different responsibilities.

Picking the Right Procedure

The decision between swing exchanging and day exchanging relies upon your exchanging objectives, risk resistance, and way of life:

Swing Exchanging:

Ideal for people with a more extended term viewpoint.

Appropriate for the people who can’t commit full-time to exchanging.

Offers a more loosened up exchanging approach with less everyday choices.

Expects persistence to brave medium-term cost patterns.

Day Exchanging:

Reasonable for those looking for transient gains and able to commit full-time to exchanging.

Requires speedy direction and the capacity to deal with intraday unpredictability.

Includes higher exchange costs however offers the potential for everyday benefits.

Requires consistent observing of the business sectors.

Eventually, the decision between swing exchanging and day exchanging ought to line up with your character, time accessibility, and hazard resistance. A few merchants even join components of the two styles to make a half and half methodology that suits their inclinations and objectives. Whichever way you pick, recall that exchanging implies hazard, and it’s fundamental to foster a strong methodology, practice discipline, and persistently work on your abilities to prevail in the unique universe of monetary business sectors.

+ There are no comments

Add yours